Investment banking, frequently referred to as the financial world’s backbone, is a complex industry that few completely understand. It’s all about dealing with big markets worldwide, companies joining together, buying and selling, and making important money decisions. These decisions affect how our economies work on a large scale.

This special area of work sits at the meeting point of money, plans, and advice. People who work here need to really understand markets, rules, and have a good idea about how money trends might go in the future.

Today, we embark on a journey to explore this fascinating world and unveil the insights and expertise of investment advisor Someshwar Srivastav.

Investment Banking Unveiled

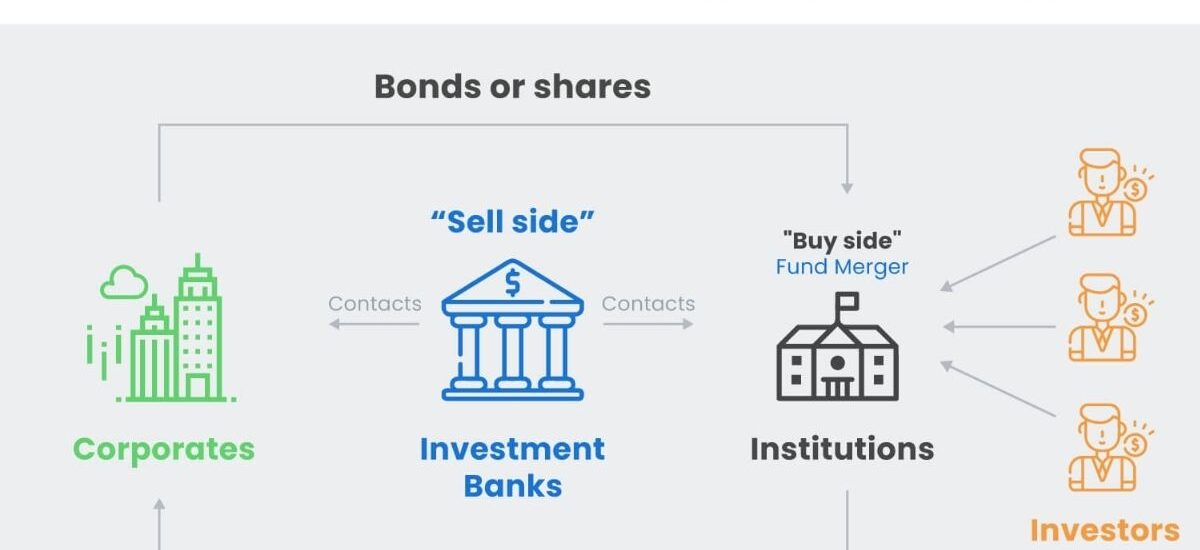

Unlike traditional banking, which deals primarily with deposits and loans, investment banking revolves around capital and securities markets.

=> It serves a wide array of clients, including corporations, governments, institutions, and high-net-worth individuals.

=> Providing them with financial services ranging from raising capital to financial advisory, mergers and acquisitions, and trading.

Investment banking is renowned for its multifaceted nature, and it is this very complexity that makes it a thrilling domain.

The industry is a finely woven tapestry of investment advisory, financial analysis, risk management, and market dynamics.

Role of Investment Advisors

In this intricate ecosystem, investment advisors play a pivotal role. They are the guiding beacons, navigating their clients through the treacherous waters of financial markets. Among these illustrious figures, Someshwar Srivastav stands as a luminary in the realm of investment advisory.

What Is the Pathway to Investment Banking?

Investment banking is a competitive and prestigious field that involves raising capital, advising on mergers and acquisitions, and providing financial services to businesses, governments, and institutions.

If you aspire to work in this dynamic industry, it’s essential to understand the pathway to investment banking. In this short piece, we’ll outline the steps and strategies to help you embark on a successful journey into the world of investment banking.

1. Educational Foundation- The first step in entering investment banking requires a solid educational foundation. A bachelor’s degree in finance, economics, business, or related fields is the preferred starting point. Some aspiring bankers pursue advanced degrees like MBA or Master of Finance for specialized knowledge.

2. Build Relevant Skills and Knowledge- Acquire critical skills for investment banking such as financial modelling, data analysis, market research, and effective communication. Stay updated on industry trends, financial news, and economic developments to enhance your market understanding.

3. Networking and Internships- Networking is crucial for entering investment banking. Attend industry events, connect with professionals on LinkedIn, and seek informational interviews. Internships with reputable financial institutions are vital, offering hands-on experience and valuable industry connections.

4. Apply for Entry-Level Positions- Apply for entry-level investment banking analyst positions, customize your resume and cover letter to highlight relevant experiences and skills in finance, and use your network for referrals to boost visibility to hiring managers.

5. Excel and Advance in Your Career- Once in investment banking, strive for excellence by showcasing a strong work ethic, a thirst for learning, and a commitment to contribute to your team’s and organization’s success. Look for chances to progress and grow within the firm.

Investment Banking Services

Investment advisors provide a wide range of services to their clients. These services encompass:

1. Wealth Management: One of the primary roles of investment advisors is to manage the wealth of high-net-worth individuals and institutions. They help clients make informed decisions about investments, ensuring that their assets grow over time.

2. Mergers and Acquisitions (M&A): Investment advisors are crucial players in the M&A process. They offer valuable insights into the financial aspects of mergers and acquisitions, enabling clients to make strategic decisions that are in their best interests.

3. IPO Guidance: Investment Advisors are known for guiding companies through the initial public offering (IPO) process. This involves extensive financial planning, valuation, and regulatory compliance.

4. Risk Management: Investment advisors assist clients in identifying and mitigating risks in their investment portfolios. This proactive approach helps safeguard wealth and capital.

5. Market Analysis: Keeping a finger on the pulse of the financial markets is a key responsibility of investment advisors. They analyse market trends and use this information to make informed investment decisions.

Challenges in Investment Banking

While investment advisors bring invaluable expertise to the table, the world of investment banking is not without its challenges.

One of the primary challenges is the unpredictability of financial markets.

Market dynamics can change rapidly due to a multitude of factors, such as economic events, geopolitical issues, and technological disruptions.

Another challenge lies in the constant evolution of regulations.

Financial markets are tightly regulated, and staying compliant with these regulations is a complex endeavour.

Investment advisors must continuously update their knowledge and adapt to changing legal requirements.

Conclusion

Investment banking is a world where strategy, analysis, and advisory services meet to create financial success stories. Investment advisors like Someshwar Srivastav exemplify the expertise and professionalism required to navigate this complex landscape. With his unparalleled insight, he has proven himself to be a guiding light in the realm of investment advisory.