Real estate has long been a lucrative investment avenue, providing individuals with an opportunity to grow their wealth and secure a stable financial future. Property’s physical aspect, along with its potential for appreciation and rental income, makes it an appealing option for investors looking to diversify their portfolios and provide long-term financial stability.

Additionally, real estate investments often serve as a hedge against inflation, preserving and even enhancing purchasing power over time.

As the demand for housing and commercial spaces continues to rise, savvy investors can leverage this trend to capitalize on favourable market conditions and maximize their returns.

To guide you on how to start investing in real estate effectively, we turn to the expertise of Someshwar Srivastav, a seasoned real estate investor with a wealth of knowledge in the field.

In this blog, we’ll unravel key steps and insights that can help beginners embark on a successful real estate investment journey.

1. Educate Yourself: Knowledge is Key

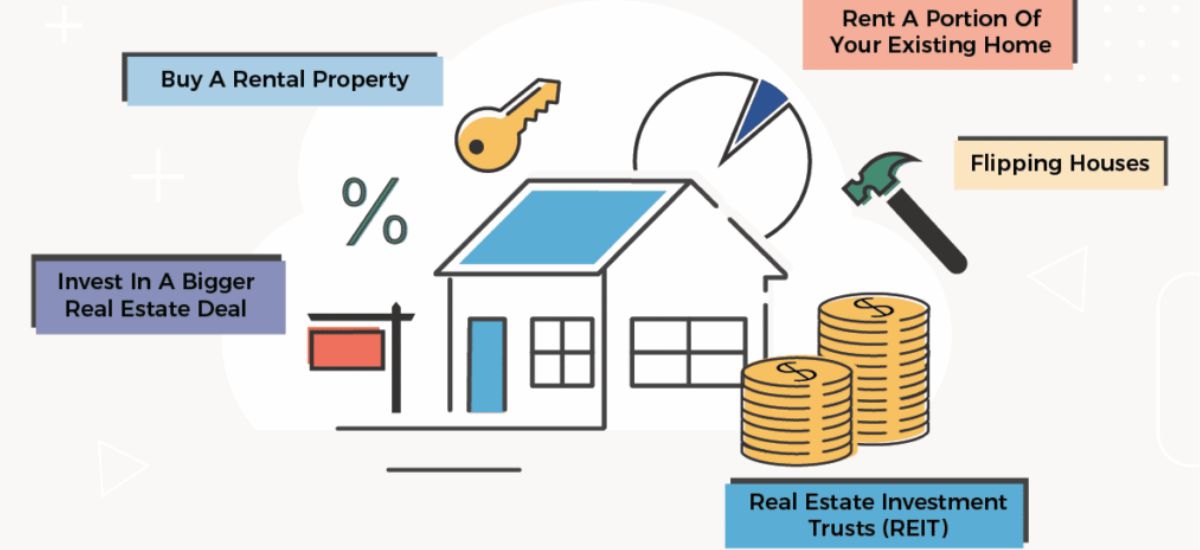

Before diving into the real estate world, it’s crucial to educate yourself thoroughly. Start by understanding the different types of real estate investments, such as residential, commercial, industrial, and retail properties.

Discover market trends, laws, financing alternatives, and property management solutions.

2. Set Clear Investment Goals

Establishing clear investment goals is vital to your success. Define what you aim to achieve through real estate investments, whether it’s long-term wealth accumulation, passive income, or a diversified investment portfolio.

Having specific goals will help you tailor your investment strategy accordingly and stay focused throughout your journey.

3. Financial Assessment and Budgeting

Conduct a thorough financial assessment to determine your budget and financial capacity for real estate investments. Evaluate your current financial situation, including savings, income, expenses, debts, and credit score.

4. Explore Financing Options

Real estate investments often require substantial capital, making financing a crucial consideration. Research and compare various financing options, such as mortgages, loans, partnerships, or crowdfunding.

Assess the terms, interest rates, and repayment schedules to choose the most suitable financing option that aligns with your financial goals.

5. Location Research and Market Analysis

Location is a fundamental factor in real estate investment. Conduct thorough research on potential locations, analysing factors such as property demand, growth potential, infrastructure development, employment opportunities, and neighbourhood safety.

6. Build a Diverse Portfolio

Diversifying your real estate portfolio can help spread risk and enhance returns. Consider investing in a mix of property types and locations to hedge against market fluctuations. Diversification allows you to capitalize on different market dynamics and potentially optimize your investment performance over time.

7. Network and Seek Expert Advice

Networking within the real estate community can provide valuable insights and opportunities. Attend industry events, join real estate forums, and connect with professionals, who have a successful track record in real estate investment.

Seeking advice from experienced individuals can provide you with practical tips and lessons from their own experiences.

8. Due Diligence and Property Evaluation

Perform thorough due diligence before making any investment decisions. Inspect properties, assess their condition, evaluate potential renovation or maintenance costs, and consider their income-generating potential.

Ensure that the property aligns with your investment goals and meets your criteria for a profitable venture.

9. Legal and Regulatory Compliance

Understanding and complying with legal and regulatory requirements is non-negotiable in real estate investment. Familiarize yourself with local laws related to property ownership, leasing, and taxation.

Seeking legal advice when needed will help you navigate the legal aspects and ensure a smooth and compliant investment process.

10. Monitor and Optimize Investments

Once you’ve made your investments, monitor their performance regularly. Track rental income, expenses, property appreciation, and overall portfolio growth. Adjust your strategies as needed to optimize returns and achieve your investment objectives effectively.

Conclusion

Diving into the world of real estate investment requires careful planning, research, and strategic decision-making.

By following these key steps and insights from experienced real estate investor Someshwar Srivastav, you can embark on a successful investment journey and build a solid foundation for financial prosperity.

Remember, patience and persistence are virtues in real estate investment, so stay committed to your goals and continuously educate yourself to thrive in this dynamic market.